News

Order N° 00000234/MINFI of 26 Oct 2020

- . 26 October 2020

- 0

- 1,561 Views

-

Shares

Order N° 00000234/MINFI of 26 Oct 2020 appointing officials in the decentralized services of the Ministry of Finance. Download Order

Order N° 00000233 / MINFI of 26 Oct 2020

- . 26 October 2020

- 0

- 1,642 Views

-

Shares

Order N° 00000233/MINFI of 26 Oct 2020 appointing officials in the decentralized services of the Ministry of Finance. Download Order

Order No. 00000232/MINFI of October 26, 2020

- . 26 October 2020

- 0

- 1,485 Views

-

Shares

Order N ° 00000232/MINFI of 26 Oct 2020 appointing officials in the decentralized services of the Ministry of Finance. Download

Press release: Call for applications for entry into the PSSFP Master

- . 21 October 2020

- 0

- 2,132 Views

-

Shares

Call for applications for entry to level 1 of the Master’s cycle of the Higher Specialization Program in Public Finance,

Indicator 3.4 monitoring report on improving forest revenue performance

- . 20 October 2020

- 0

- 1,896 Views

-

Shares

CAMEROON-EUROPEAN UNION: Towards increased mobilization of forest revenues The Republic of Cameroon and the European Commission, acting on behalf of

Note on the new system for collecting customs duties and taxes on imports of telephones and terminals

- . 12 October 2020

- 0

- 4,427 Views

-

Shares

UNDERSTANDING THE REFORM UNDERTAKEN BY THE GOVERNMENT ON THE SYSTEM OF DIGITAL COLLECTION OF CUSTOMS DUTIES AND TAXES DUE ON

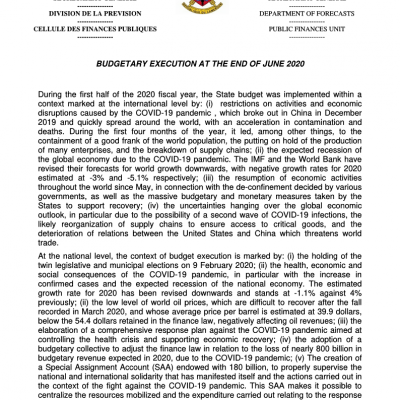

BUDGETARY EXECUTION AT THE END OF JUNE 2020

- . 7 October 2020

- 0

- 1,592 Views

-

Shares

During the first half of the 2020 fiscal year, the State budget was implemented within a context marked at the

Financing of SMEs

- . 2 September 2020

- 0

- 2,499 Views

-

Shares

A 10 billion line of appropriations for SMEs The announcement was made after an audience between the Minister of Finance,

Transparency

- . 28 August 2020

- 0

- 1,870 Views

-

Shares

Louis Paul Motaze invites banks and MFIs to inform the NEFC platform The Minister of Finance addressed this request to

Indebtedness

- . 28 August 2020

- 0

- 2,503 Views

-

Shares

A credible and sustainable mobilization The country intends to increase its external fundraising capacity to 45% of GDP by 2023.